Bringing the Economy to Life in the Classroom

Ivybridge Community College’s Department of Economics and Business welcomed the Bank of England, virtually, into their classrooms this term.

Michael Pywell is a Bank Ambassador and Policy Analyst for the RTGS Renewal Policy Implementation Team at the Bank of England, and he generously offered to speak to our young economists. He informed students about the Bank of England’s work as well as promoting potential career options in the field of finance and economics. This programme has been designed to help widen participation in the academic study of economics and inspire the next generation of economists.

Michael studied Economics at A Level and then continued to University to study Economics at degree and masters levels. Following employment on a bank graduate scheme he then worked in the private sector for a few years before moving to the Bank of England to get more exposure to central banking and policymaking. “There are a number of routes into the Bank and my general experience is that you don’t necessarily need a finance related degree to go on to have a career in finance,” he said.

“The Economics and Business Department boasts a fantastic provision for Economics and now offers both GCSE and A Level examinations in the subject to complement our range of business qualifications. We invited all of our economists from Years 9 to 13 to this talk on how Monetary Policy is being implemented by the Bank of England during these uncertain times. This talk was real, relevant and up to date,” said Sam Brooks, Head of Economics and Business.

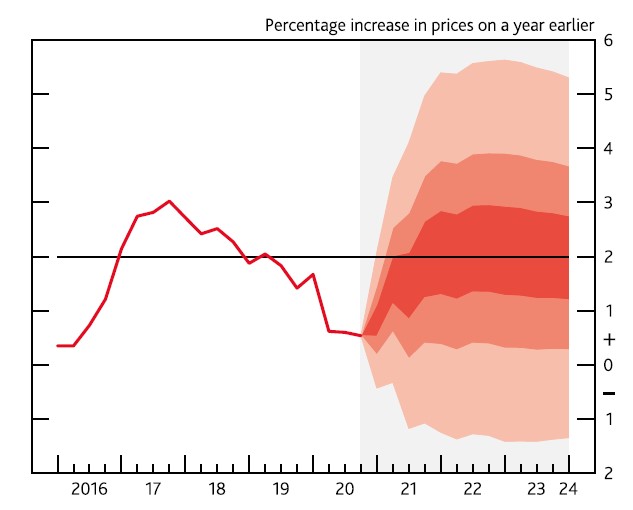

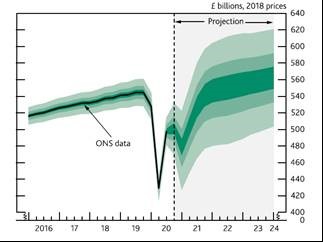

Michael shared some interesting data and charts with the students which were generated by the Monetary Policy Committee;

The Outlook for Consumer Price Index (CPI) Inflation and Gross Domestic Product (GDP) (Monetary Policy Report, February 2021)

He explained that the graphs show the target rate of inflation is 2%, and that the Bank of England largely forecast for the economy to be within the reach of this target over the next few years, thereby promoting economic stability.

Sam added, “The students asked some really interesting questions around how successful they think the current expansionary Monetary Policy is and whether the low interest rates have supported us through the pandemic.

It was wonderful to see our students engaging with this topic at such a high level, and it is clearly evident that the students are reading around the subject and understand economics in the real world.

The Bank of England are committed to promoting diversity in their field, and so they offered this presentation to us in a bid to make economics accessible for all. This is something we are very passionate about in the department, and we hope to continue to bring this subject alive in our lessons by looking at Economics in the real world. We hope to continue to inspire our young economists to embark upon successful careers in the world of economics and follow in the footsteps of many of our alumni economists.”

Year 11 student, Rudi, commented after the meeting “I was intrigued by the various roles and responsibilities within the Bank of England, which resulted in my engagement in a detailed explanation of economics in a current affairs context.”

One Year 13 economist said, “The presentation was really helpful and linked directly to what we were studying in class. It helped me prepare for my final assessments.” Another Year 13 student added, “It made me realise how useful Economics A Level is because I always thought working for the Bank of England would be a higher level than any content learnt at A Level, but I was aware of most things he spoke about which was reassuring. When Mrs Brooks said that we become “young economists” by the end of A Levels I think this is true because I could go and pursue a career in this area if I wanted to.”

“I found it was extremely interesting when he was speaking about the other jobs the Bank of England has, and when he spoke about the quantitative easing I felt that was quite useful and educational and gave me a good insight into what the bank does.” Year 10 economist.